ADVISORY SERVICES

Risk Management

Risk can be good if you know how to manage it

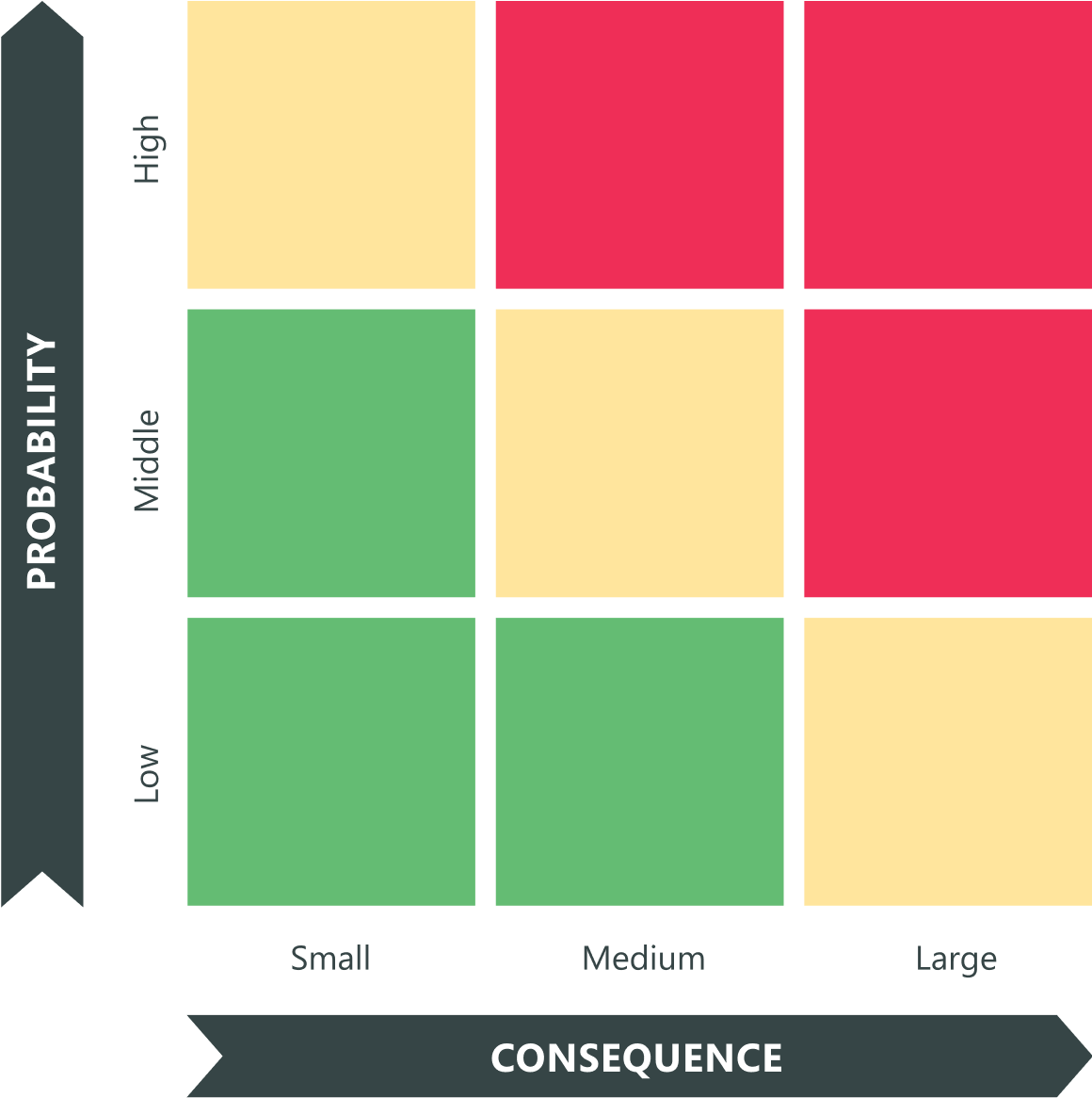

Risk management enables clients to attempt to control future outcomes. Having this proactive approach is key as it can influence project success or failure. Integrating risk management in the early stages, when the ability to influence outcomes is at its peak, helps to minimise risks and unnecessary costs.