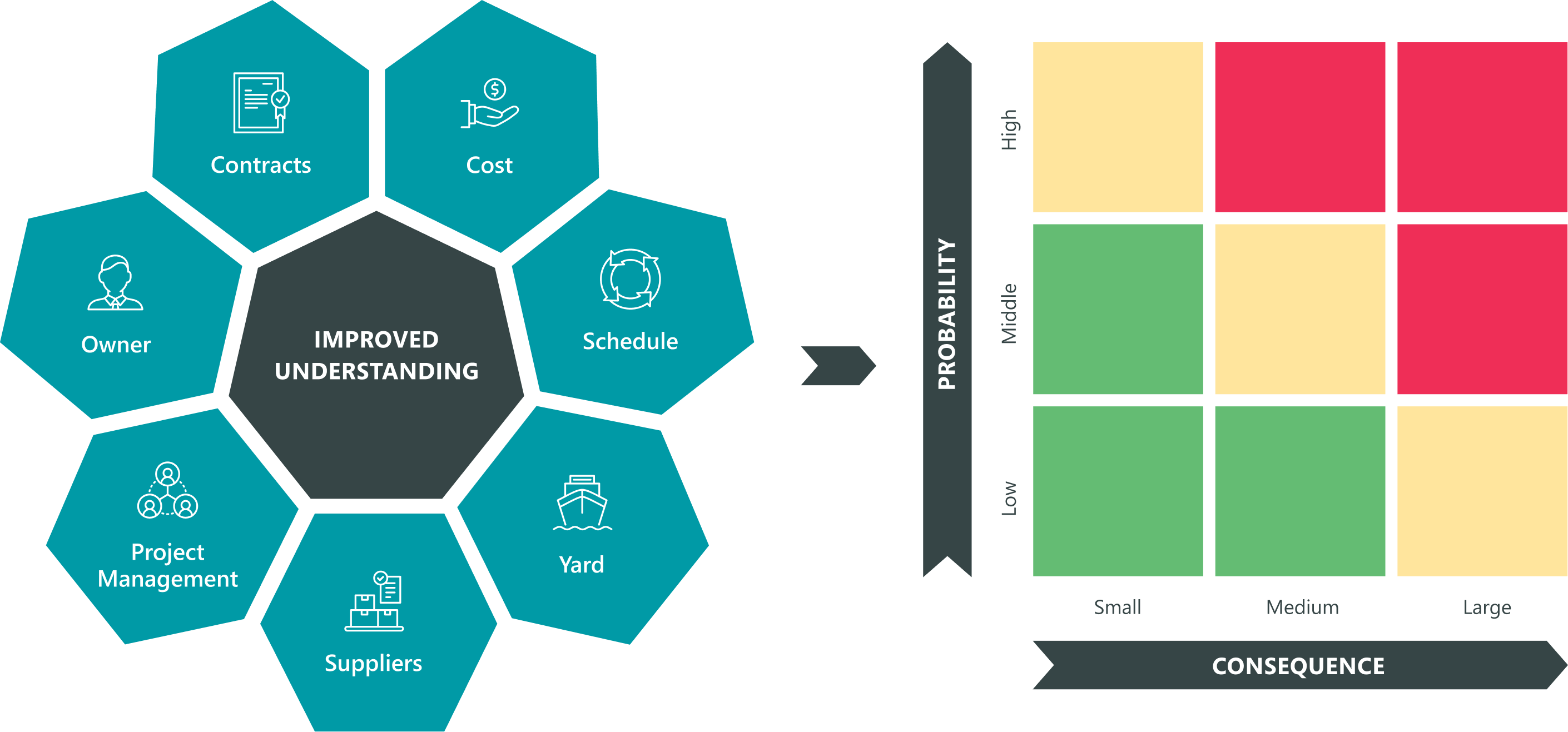

We provide prospective investors with an improved understanding of assets through our transactional services:

- Building on our expertise and values

- Leveraging our multidisciplinary teams and cutting-edge capabilities

- Optimising opportunities and value creation

- Reducing or mitigating risks with innovative solutions

Technical Due Diligence

A TDD exercise aims to disclose risks in order to enable transaction parties to manage risks posed by issues such as such as cost overruns, delays as well as poor technical and operational performance.

We translate unclear dependencies into quantifiable items, in the form of a risk matrix/register:

Commercial Due Diligence

We provide a thorough understanding of a company and its assets’ ability to meet forecasted results, considering the external landscape in which it operates/will operate in. Both the competitive landscape and market share will be taken into consideration. Based on this, an informed decision on whether to proceed can be made.

Owner’s Engineer

Acting as an Owner’s Engineer, we provide the prospective owner/buyer with an improved understanding of technical issues allowing informed decisions to be made, such as an investment decision. In this role, we may look into and opine on items such as:

- Design

- Main Project Participants

- Risk Register

- Project team

- Contracts

- Project Schedule

- Budget (CAPEX) including contingencies

- Market

- Economic Robustness

- Operations Philosophy

- Operations Budget (OPEX)

- Rules, Regulations and Class

Lender’s Engineer

Acting as a Lender’s Engineer, we protect the interests of a lender, for example, that HSE requirements are adhered to or that quality of workmanship is in accordance with specifications. This involvement may be in the follow-up of the construction of a single piece of equipment or a complete system or structure. Also, elements such as cost, schedule and project team composition, would typically be included. This role typically extends to other areas such as engineering, construction and commissioning.

Construction Monitoring

Making sure that construction is progressing as intended is key to meeting project objectives, successful handover and final acceptance. Factors such as time, cost and quality must be monitored over time to make sure that no single issue is allowed to develop into a serious one.

During construction monitoring, monthly or bi-monthly progress reports are typically issued to clients, regarding key project milestones and more.